31+ Mortgage borrowing times salary

So far in 2020 the average mortgage size for first-time buyers was 170301. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their.

Tips For First Time Home Buyers Myhomeanswers

A mortgage for seven times salary offers the chance to buy a bigger home or save a smaller deposit but the number of people who will take out the Habito One loan is minimal.

. Use our borrowing power calculator to get started. This is a 5 decrease from. Any way of borrowing more than three times my salary for a mortgage.

Despite three increases in the Bank of. Yet today even borrowing six times salary or 300000 the annual payments would come to just under 21300 and 43 per cent of earnings. The maximum you can borrow varies between lenders but as a guide it would be up to a maximum of 95 of the propertys value.

Mortgage borrowing times salary Senin 12 September 2022 Edit. Under this particular formula a person that is earning. We can find you a mortgage offer with several lenders offering deals equivalent to five times your salary if you earn at least 75000.

Well help you determine what kind of property and mortgage you can afford based on your salary. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. Generally lend between 3 to 45 times an individuals annual income.

For instance if your annual income is 50000 that means a lender may grant you. An ongoing low variable discount interest rate. Shows the cost per month and the total cost over the life of the mortgage including fees interest.

Mortgage borrowing times salary Jumat 09 September 2022 Edit. Many people are borrowing up to seven times their salary saddling themselves with crippling mortgage debts lasting up to 50 years. Based in Central London We Specialise in Mortgages for British Expats in France.

Halifax recently changed some of the loan-to-income LTI limits applied to its affordability. There are two different ways you can repay your mortgage. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

Easy Step by Step Directions. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

In monetary terms you will typically be able to. If you dont know how much. There were 351000 first-time buyer mortgages completed in 2019.

Your annual income before taxes The mortgage term youll be seeking. Nine banks and building societies currently allow customers to borrow five times their income but the earnings requirements vary from 13000 a year to 100000. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

However because of the frequency of mortgage lates committed by homeowners in recent years some. Mortgage lenders in the UK. As you pay off your mortgage part of each monthly repayment covers the monthly interest owed on the mortgage balance and part goes towards reducing the mortgage debt.

Your monthly recurring debt. Banks can apply exceptions over Loan-to-Income LTI caps on up to 20pc of their mortgage business for first-time buyers and 10pc of second and subsequent buyer. Capital and interest or interest only.

We calculate this based on a simple income multiple but in reality its much more. How much mortgage can you borrow on your salary. Firefighter nurse paramedic doctor police accountant barrister.

Banned with Prison Access Posts. Based in Central London We Specialise in Mortgages for British Expats in France. If you are unable.

The interest rate youre likely to earn. With a capital and interest option you pay off the loan as well as the interest on it. Owner Occupier Principal Interest.

Toggle menu toggle menu. Some are purchasing properties with. To borrow up to 7 times your salary you must earn at least 25000 if you work in any of the following jobs.

For loans up to 1m at up to 75 LTV meaning a minimum deposit of 25 the.

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Document

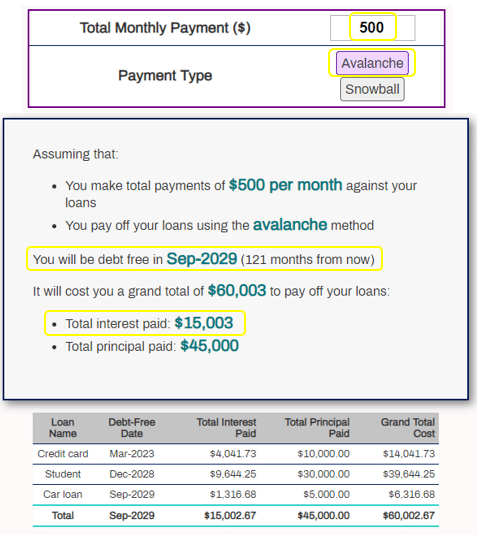

The Measure Of A Plan

Home Budget Template Basic Budget Template How To Make Basic Budget Template For Personal Ne Home Budget Template Budget Template Household Budget Template

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

2

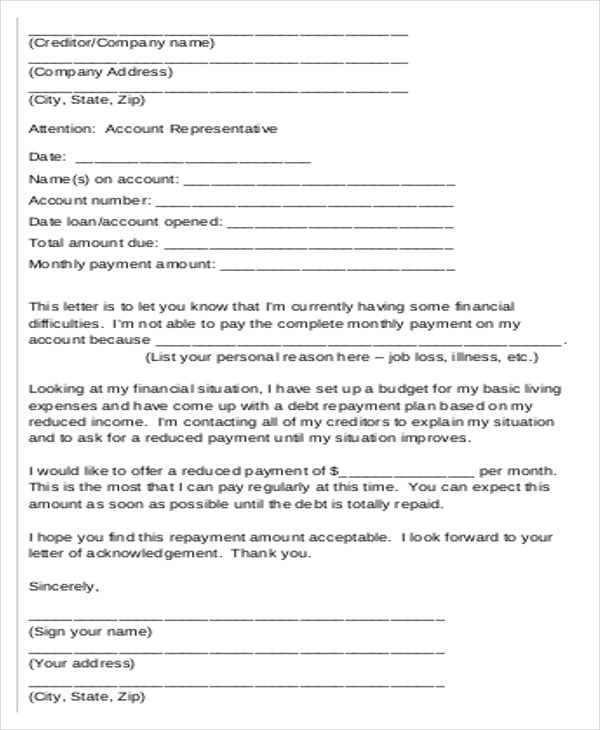

13 Payment Acknowledgement Letter Templates Pdf Doc Free Premium Templates

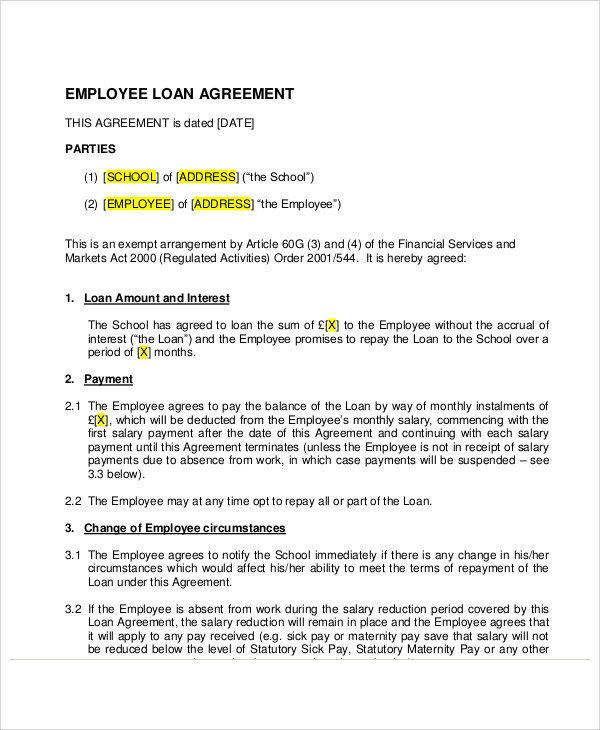

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

16 Proof Of Income Letters Pdf Doc Free Premium Templates

How To Make Money Fast Up To 10 000 Hr

G201504061231506422617 Jpg

2

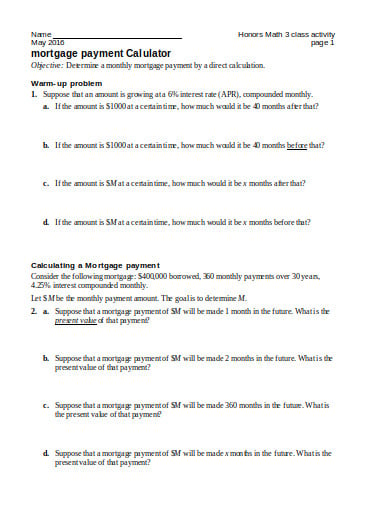

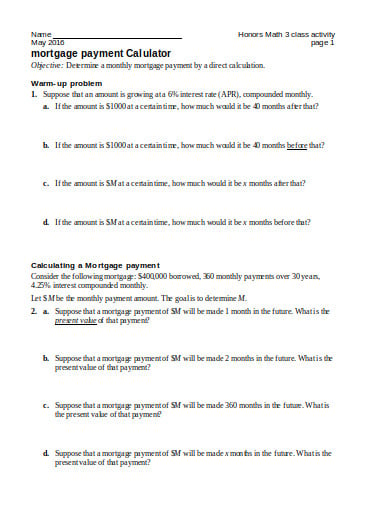

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

G201504061231509392619 Jpg

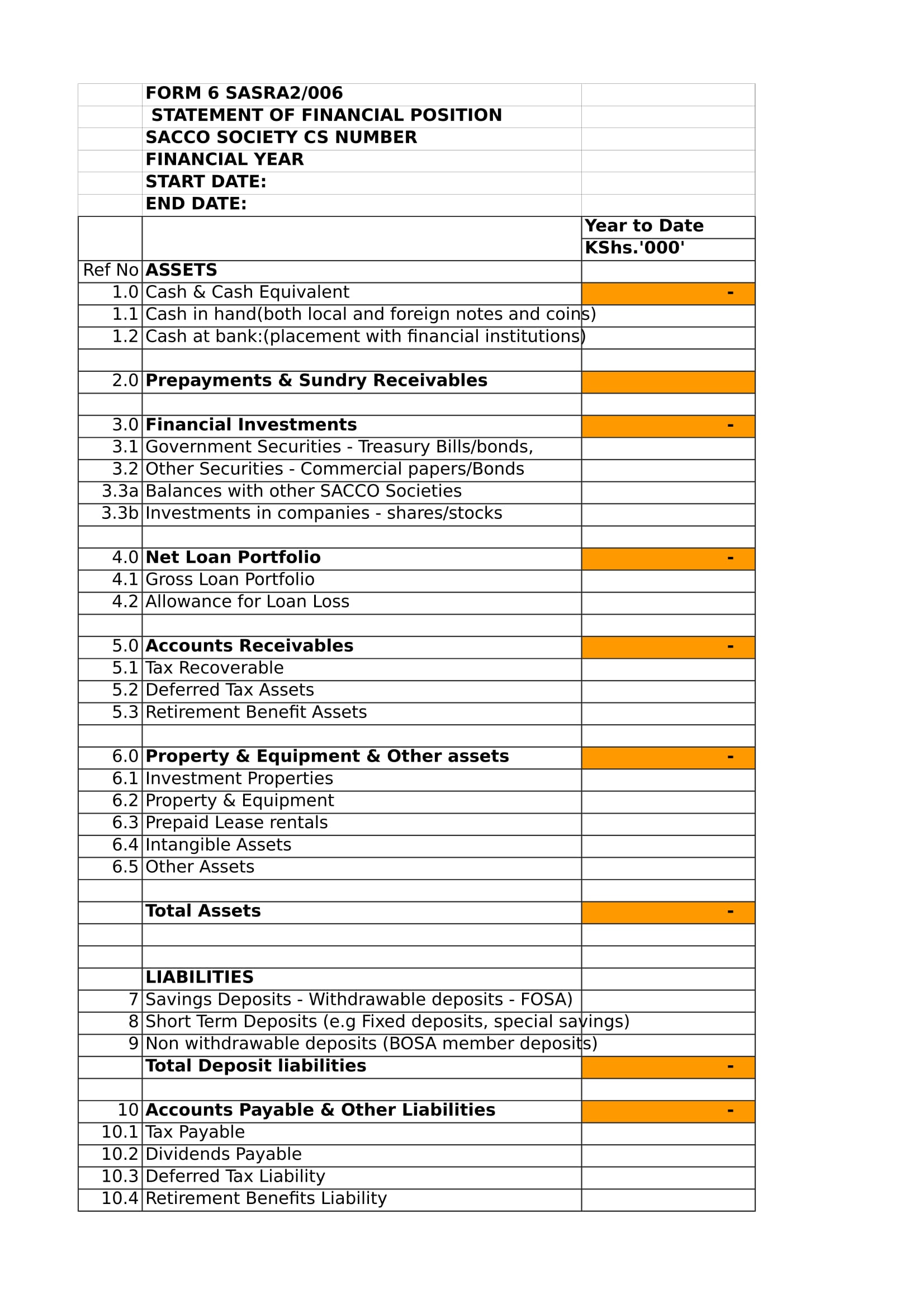

Free 31 Statement Forms In Excel Pdf Ms Word

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans